Highly Compensated Employee 401k 2025 - Irs 401k Highly Compensated 2025 Valli Isabelle, Department of labor (department) announced a final rule, defining and delimiting the exemptions for executive, administrative, professional, outside sales, and computer employees, which will take effect on july 1, 2025. Hces are typically executives, managers, or other highly skilled or specialized employees who earn a higher income than other employees within their company. Unless your plan terms provide otherwise, the salary (elective) deferral limit is applied uniformly to the compensation that the employee receives throughout the year. Department of labor (department) announced a final rule, defining and delimiting the exemptions for executive, administrative, professional, outside sales, and computer employees, which will take effect on july 1, 2025.

Irs 401k Highly Compensated 2025 Valli Isabelle, Department of labor (department) announced a final rule, defining and delimiting the exemptions for executive, administrative, professional, outside sales, and computer employees, which will take effect on july 1, 2025. Hces are typically executives, managers, or other highly skilled or specialized employees who earn a higher income than other employees within their company.

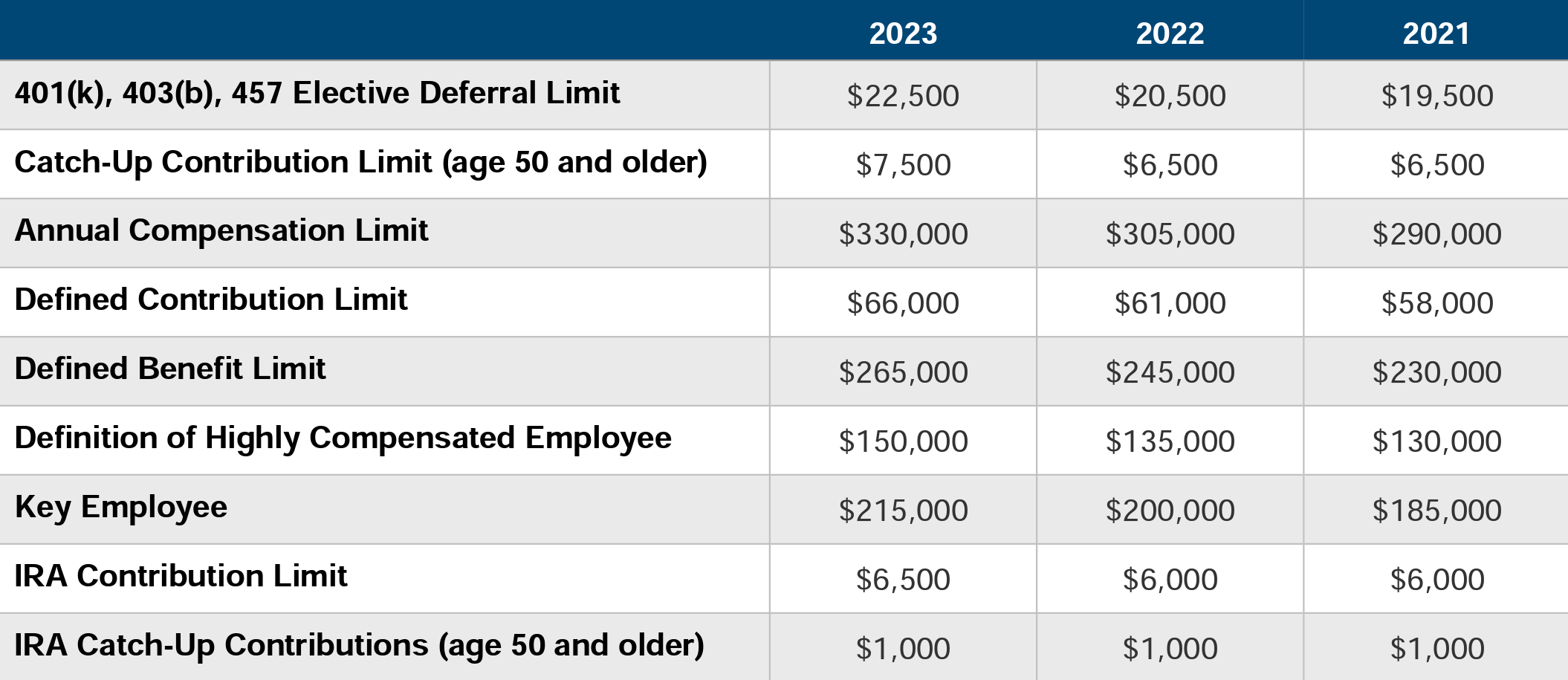

2025 Highly Compensated Employee 401k Misha Tatiana, Generally, a 401 (k) participant can contribute up to $23,000 to a 401 (k) in 2025 ($22,500 in 2023). In 2025, employees and employers can contribute a combined maximum of $69,000 (or $76,500 if the employee is age 50 or older).

Hces are typically executives, managers, or other highly skilled or specialized employees who earn a higher income than other employees within their company. That adds another $8,000 to the contribution.

Highly Compensated Employee 401k Options, Limits for highly paid employees. You may need to work at a company for a.

Increased by $500 from 2023 to 2025, allowing employees under 50 to contribute up to $23,000.

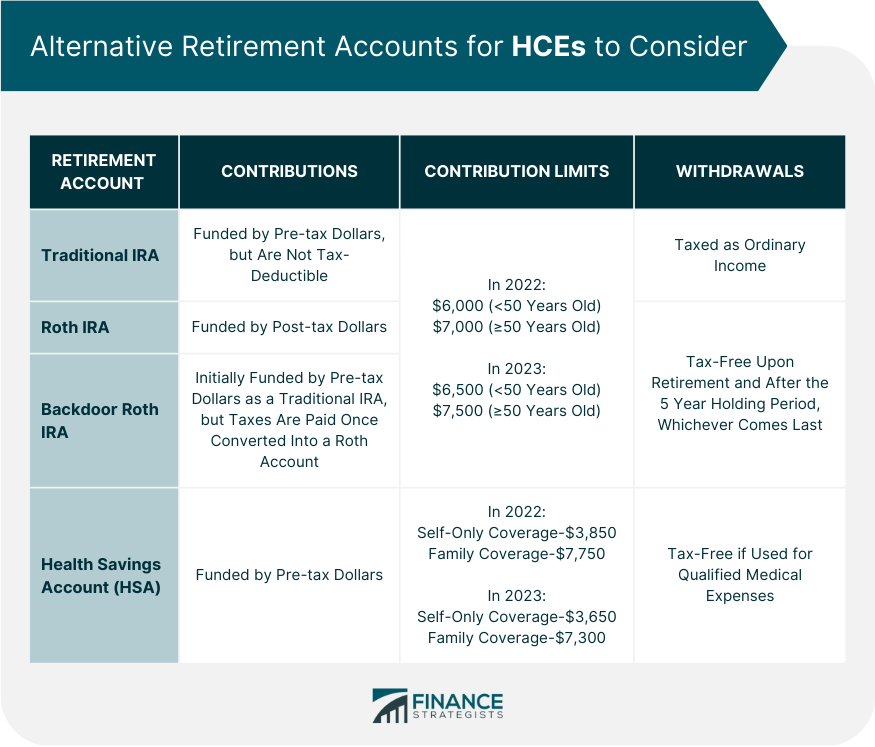

Discover how hces are defined, the additional limits they face, and strategies to potentially maximize their retirement savings.

Highly Compensated Employee (HCE) 401(k) Contribution Limits, The limit for combined contributions made by employers and employees cannot exceed the lesser of 100% of an employee's compensation or $69,000 in 2025. The limit on employer and employee contributions is $69,000.

401K Plans Secure Act 2.0 from Bad to Worse Highly Compensated, The 401 (k) contribution limits for 2023 are $22,500, or $30,000 if you're 50 or older. The threshold for determining who is a highly compensated employee under section 414(q)(1)(b) increases to $155,000 (from $150,000).

401(k) Contribution Limits for Highly Compensated Employees, The irs also sets limits on how much you and your employer combined can contribute to your 401 (k). These figures play a crucial role in maintaining fairness and equity in the administration of 401(k) plans and preventing any undue advantages for specific groups of employees.

Highly Compensated Employee 401k Options, That adds another $8,000 to the contribution. Similarly, highly compensated employees are identified based on a compensation threshold of $155,000.

2025 Hce Compensation Limit Nevsa Adrianne, Discover how hces are defined, the additional limits they face, and strategies to potentially maximize their retirement savings. Who is a highly compensated employee?

401 (a) (17) and 408 (k) (3) (c) compensation will rise to.

.png?width=795&name=Other_Retirement_Vehicles_HCEs_Can_Consider (1).png)